As you know, yesterday’s FZ Daily was about why we don’t believe in Dollar Cost Averaging.

A very astute Financial Zen Member responded and asked if it matters if you put in a lump sum right

before the market tanks.

Without knowing it, he was referring to something in finance-ese called “Sequence of Returns Risk”.

And the answer is NO. As long as you’re not withdrawing money, it doesn’t matter when you get the bad

returns.*

In anticipation of the Giants beating the Dodgers tonight. I’ll use the NLDS as an example.

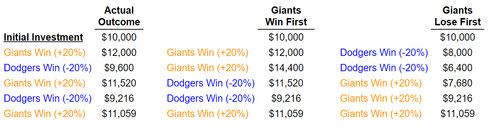

Let’s assume when the Giants win your portfolio goes up 20%.And when the Giants lose your portfolio

goes down 20%.Below are three examples:1. How it actually happened (once the Giants win tonight).2. If

the Giants won the first two games.3. If the Giants lost the first two games.

As you can see, no matter what happens in the first two games, when the Giants win the series you end

up with with the same total return – $11,059.

This is a common financial gotcha. It runs counter to what “feels right”. But the math doesn’t lie.

And that’s why it’s a fun one to show off with at your next neighborhood BBQ. No one gets this right.

(Extra points if you work “Sequence of Returns Risk” into the conversation. ????)

See you in the National League Championship!

(Except you, Keith. Sorry for your loss. NOT!)

Go Giants! Beat LA! Go Giants! Beat LA! Go Giants!

*If you’re withdrawing money when the market tanks, then it most definitely matters. That’s why we set

aside 10 years of living expenses in bonds before you retire. That way once you’re living off your savings,

it still doesn’t matter if the market tanks immediately right after you retire.