How do you know if your house is a good investment?

We’re talking about your primary residence. Where you watch your kids grow up. Where you have your friends over for dinner. Where you watch America’s Got Talent every Tuesday (just me?).

Is THAT a good investment?

And we’re not talking about the pride of ownership. Or the fulfillment of providing for your family. Or the sentiment of all the memories you’ve built inside those walls.

We’re talking cold, hard cash. Dollars and cents. Is your home a good financial investment?

To answer that we need 3 things:

1. The increase in your home value

2. Inflation

3. Comparison to other investments

Let’s look at the last 30 years.

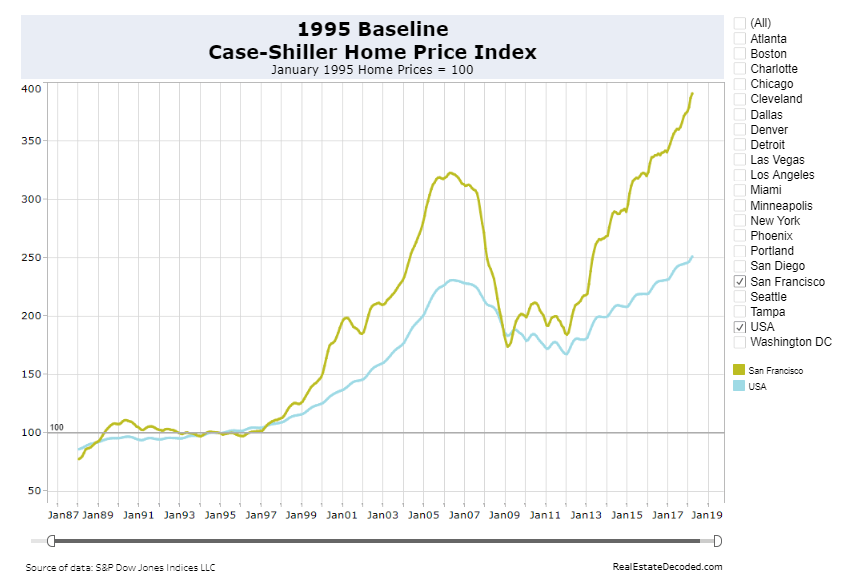

Below is a chart mapping average home prices from 1988 to today for the Bay Area (Go Giants!) and the country:

If you bought a house in the Bay Area in 1988 for $79,000, it’d be worth $390,000 today. Not too shabby! That’s nearly a 500% total return, or an annualized return of 5.4%!

If you bought a house in Anytown, USA for $86,000, it’d be worth $248,000 today. You tripled your investment!

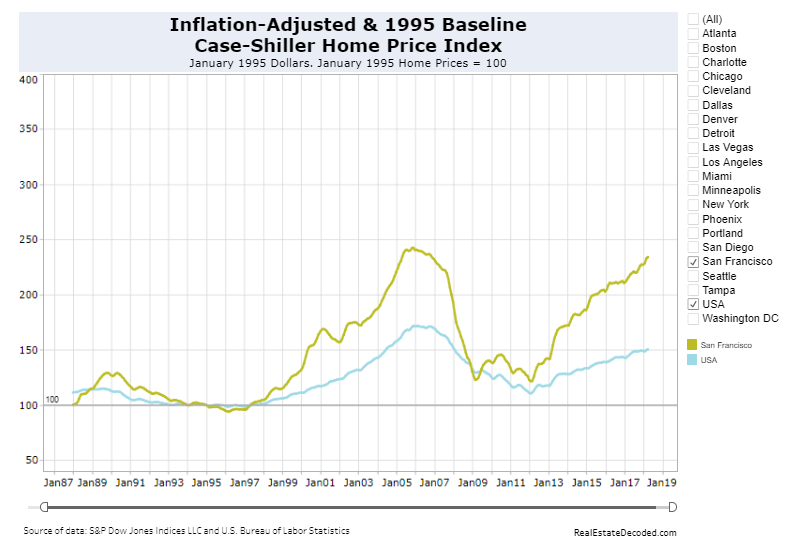

But what about inflation? Whomp whomp.

Inflation has been roughly 3% per year since 1988.

When you factor in that a dollar today is worth much less than a dollar in 1988, the picture’s not so rosy.

If you bought a house for $101,000 in the Bay Area 30 years ago, it’d be worth $233,000 today in 1988 dollars.

That’s a whopping 2.8% annualized return. Boo!

If you bought in Anytown, USA for $111,000, it’s now worth $150,000 today in 1988 dollars. That’s a 1.0% annualized return. Lame.

Finally, let’s compare what the inflation-adjusted returns of the S&P 500 has done over that time frame.

Since 1988, the stock market has returned 7.6% annually (vs. 2.8% for a Bay Area home or 1.0% in Anytown). That’s adjusted for inflation and assumes you reinvest dividends.

If you forget inflation, it’s annualized return is 10.4% (vs. 5.4% for a Bay Area home or 3.6% in Anytown).

So there are a LOT of reasons to buy a house – pride, fulfillment, memories – but making money isn’t one of them.