“Please tell me you put my entire portfolio in SNAP this morning.

— Anonymous Client 3/2/2017

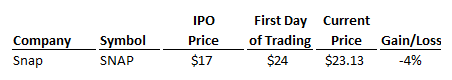

On March 2, Snapchat IPO’d. In its first day of trading, it was up 40%.

My client was joking, because all of my clients know I’m not a stock picker.

People give me their “Serious Money” to manage. I let them handle their “Funny Money,” which is where stock picking belongs. But that’s not the subject of this blog post.

IPO-hype is rampant, especially in the Bay Area.

When new high-profile IPO’s are scheduled people ask how to get in (hint: you can’t).

But is that enthusiasm justified?

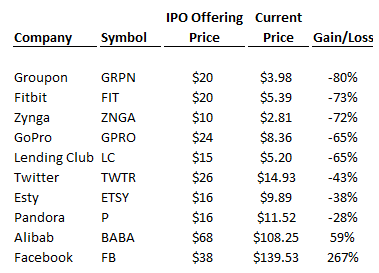

Below are 10 high profile IPO’s over the last 7 years.

Groupon

Zynga

Esty

GoPro

Pandora

Twitter

Alibab

Fitbit

Lending Club

Facebook

Guess how many of these have been good investments? Just 2.

That’s right.

Out of these 10 high-demand IPO’s, only two of them have given investors a positive return.

Facebook and Alibaba. Everyone else took a bath.

The bloodbath is actually worse when you consider that Joe and Jane Public didn’t purchase these stocks at their IPO price.

The only way to get “in” on an IPO is to either a) work for the company going public or b) be a highly affluent investor.

So unless Joe and Jane work at SNAP, they purchased shares after it started trading. The opening price for SNAP was $24. If Joe and Jane bought into the hype of SNAP the first day, they are down 4%.

The lessons here are simple:

- If you work for a company that goes public, divest your company stock as soon as you can and diversify.

- Don’t buy IPO’s. The odds of picking the winner are not in your favor.