Editor’s Note (doesn’t that sound fancy?): The universe really wanted to drive this lesson home. As if on cue, between writing this last week and publishing it this week the market bounced back nearly 3% in just two days.

The market dropped 6% last week. EEEEKKKK!!!!!

Hope your bomb shelter’s stocked up on shotgun shells and canned goods because we are running for the hills…again!

Surely we should worry this time, right?

Only the smartest people read my newsletters, so I know you already know the answer. Of course not.

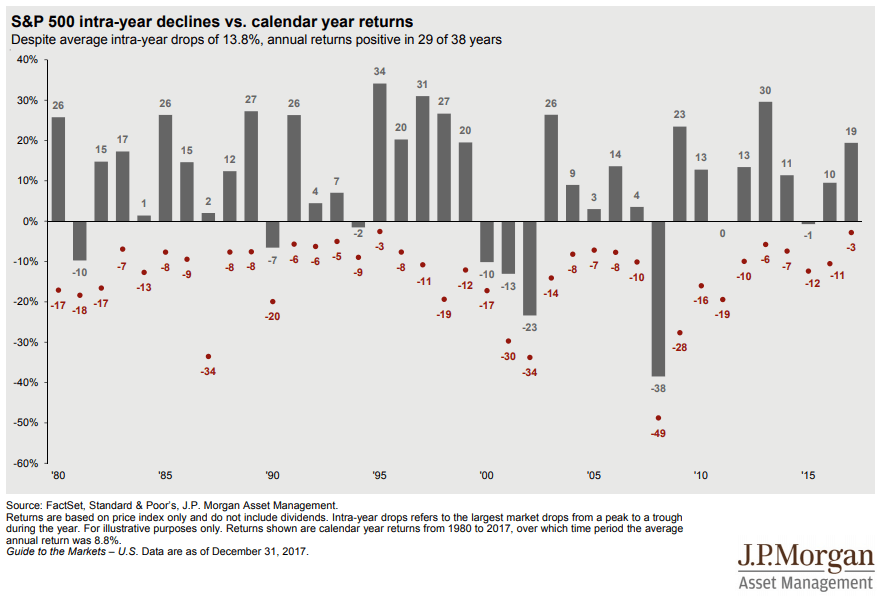

Pictures are fun. Below is a picture of market returns since 1980. The gray bar is the total return for the year. The red dot is the lowest point it reached that year.

Look at 1980. At some point between January 1, 1980 and December 31, 1980, the market was down 17%. Oh noooooooo!!!!!

But wait.

By the stroke of midnight on New Year’s Eve, it was up 26% for the year! Woohoo!

It bounced back 43% from the lows that year. That’s one helluva year!

All those people who dove into their bomb shelters when it was down 17% actually had nothing to worry about.

And I bet you dollars to donuts before they dove for cover, they sold all their investments “before it got worse.”

Then I’ll double down and bet they missed out on some – if not all – of the recovery because they were too scared to “get back in.”

So not only did they not bring in the New Year with 26% more money than they had a year before, but they were probably down 17% because they sold everything at the bottom and never got back in.

As our Commander-in-Chief would say – SAD!

The lesson is simple. Whatever is happening at this moment has ZERO predictive power over what will happen in the next moment.

I’m sure when the market was down 17% in 1980 no one was saying “I bet it recovers 43% and finishes the year up 26%.” NO. ONE.

So what should we do? Go to work. Spend time with our friends and family. Enjoy our lives.

After all, we’ve seen this movie before. We know how it ends. If you’re patient and give it enough time, it always has a happy ending.