Your last bonus was $30k.

Do you…

1) Invest it all at once or2) Invest $10,000 each month for 3 months?

The answer can be found in JP Morgan’s Guide to Retirement.

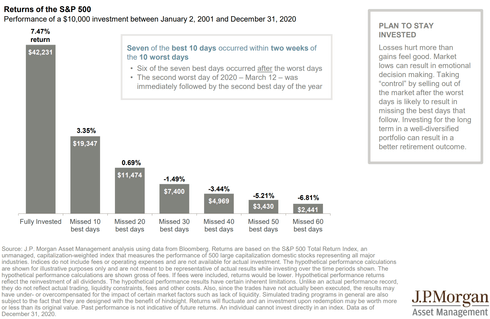

Below, you’ll see what missing the best days in the market can do to your portfolio returns.

If you only missed the best 10 out of the last 2500 trading days (about 20 years), your annual return drops

from 7.47% to 3.35%.

Miss the best 20 days and you only got 0.69% per year.

And if you missed the best 30 days, you actually LOSE money.

So what should you do?

Should you put it all in and make sure you don’t miss one of the best trading days?

Or do you take a chance and dollar cost average because you’re afraid of a temporary market decline in

the next 90 days?

Ultimately, it’s for you to decide, but you’ll never hear me talk about investing slowly.

All your investable money should be invested at all times.

It’s the time IN the market, not the timing OF the market that makes you money.